The global recall of respirators and the group’s #restructuring have been weighing heavily on Philips for months. After surprisingly good business figures, investors are now hoping for a turnaround.

It was with positive surprises for Philips shareholders: After a pitch-black year 2022, the Dutch company reported back with surprisingly strong figures – although analysts had not expected this and had previously put the share partly on “Sell”.

Operating profit climbed 50 percent in the first quarter compared to the same period last year, while sales figures were up 6 percent. Philips stocks rose 11 percent to almost 20 euros – and that after having temporarily lost more than 80 percent of its market value since spring 2021.

The reason for this was, among other things, a loss of 1.6 billion dollars in the past fiscal year after Philips had to recall and write off around 5.5 million #ventilators worldwide. Like other companies, Philips is also suffering from high inflation and supply chain problems. Group restructuring is also costing money. In recent years, the formerly broad-based electrical group has undergone major restructuring and now focuses mainly on the medical technology sector. This was done through the development of X-ray equipment and various corporate acquisitions in this sector.

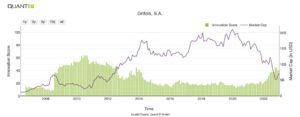

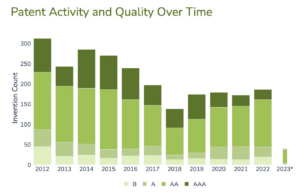

The group has retained its innovative strength, if you look at the Quant IP analysis: Most of the time during the past 5 years Philips had a Quant IP Innovation Score of 80 or more. A technology disruption index of 100 indicates that Philips is very well suited to withstand disruptive technology forces. The company is likely to disrupt rather than be disrupted in the near future. Philips is ranked number 1 in the Quant IP Technology Ranking, which shows how the company was positioned within its peer group over time regarding its innovative output.

For shareholders, innovation could soon pay off. The new CEO Roy Jakobs, who has led Philips since October 2022, had promised to significantly increase the company’s #productivity again. In order to become more profitable, the savings program and thus above all job cuts are to be continued. At the same time, Philips is striving to cushion the consequences of the ventilator recall and the associated class action lawsuits. In addition, Philips is working on an agreement with the U.S. Department of Justice and the Food and Drug Administration (#FDA) so that the company can soon put the recall disaster behind it.

Conclusion: Against this background, the stock is definitely an exciting investment for #value investors. The signs are pointing to a new dawn and the stock is inexpensive with a P/E ratio of 17. The dividend yield of just under 5 percent also makes the stock attractive. In addition, the stock price is still around 60 percent below its all-time high of around 50 dollars.