Grifols shares have lost more than 60 percent in the past three years. Many signals – including a rising QUANT IP Innovation Score – now point to a turnaround.

When the Spanish drug manufacturer announced the completion of the takeover of the German pharmaceutical company Biotest for around 1.9 billion euros about a year ago, market expectations were high. Grifols – a leading global supplier of plasma derivatives and diagnostics – had primarily strategic goals with the acquisition: Thanks to the strong European presence of Biotest, the Spanish group’s position in Europe was to be strengthened and business, industrial and scientific expertise bundled.

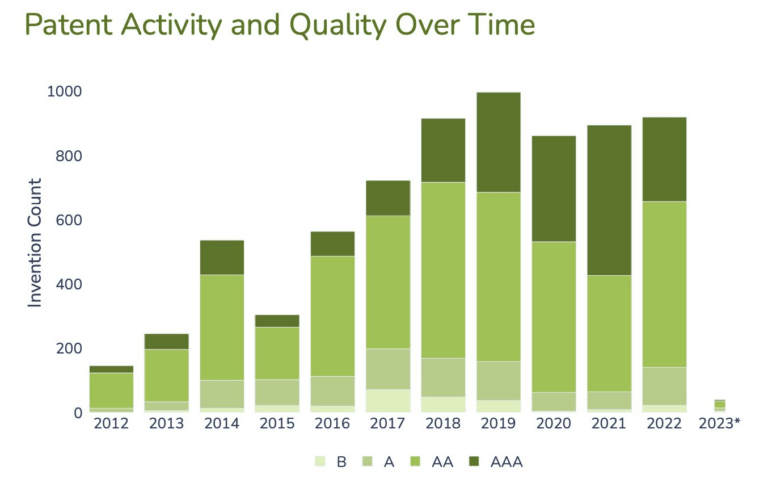

One important goal was the expansion of plasma centres. With the acquisition of Biotest, Grifols has been able to increase the number of its plasma centres by 26. In total, Grifols plans to increase the number of its plasma centres worldwide from 350 to 530 by 2026. In addition, the acquisition has improved the product range as well as research and development capacities. The latter is of great importance in global competition – and shows first successes: the number of inventions doubled in 2022 compared to the previous year. This also had an impact on the IP Quant innovation score. While this score was around 20 for many years, it increased significantly in 2022 and was recently above 40. In addition the patent quality is very good: The company’s patent portfolio average IP Quant quality rating is AA, meaning that, on average, Grifols patents are better than 73.6 % of comparable patents from competitors.

The positive development of its innovation activity is reflected in its recent financial results. Grifols’ business momentum has led to sales of 2.81 billion euros in the first half of 2022 – a growth of more than ten percent. The EBITDA increased to 618.3 million euros in the first half of 2022, with a margin of 22 per cent, compared to 327 million euros and 13.6 per cent in the second half of 2021.

The strong business fundamentals, steady improvement in profitability and operating cash flow, as well as discipline in capital allocation and, last but not least, continued R&D activity will ensure that Grifols succeeds in expanding its position, especially in the global pharmaceutical market.

These prospects have recently boosted the share: after it had been in a downward trend since 2020 due to weak business numbers and had lost more than half of its value. While the share price was still 8 euros six months ago, it is currently trading at around 13 euros – an increase of around 60 percent. And the trend is likely to continue if Grifols continues to pursue its goals so consistently.

Conclusion: Grifols shares should be kept an eye on. The solid business base, good strategic decisions and innovative strength could help the Grifols share achieve a sustainable turnaround.