Almost everyone knows eBay, as the company was one of the first major players on the Internet. However, the share is often not so much in the focus and, at first glance, is nothing to get excited about: It has not been particularly lucrative in recent years – on the contrary: eBay’s share price is around 45 percent below its all-time high. Against the backdrop of weakening economic growth, however, it could become an outperformer.

After years of moving more and more in the direction of other big online retailers such as Amazon, eBay’s business model is now returning more to its original concept as an online auction house – selling less new products and more second-hand goods, collectibles and handmade items – and is thus striking a chord with an entire generation: the GenZ, i.e. the people who came into the world between 1997 and 2012.

In fact, eBay perfectly alludes to some of the GenZ’s core themes, such as sustainability, circular economy and secondhand. eBay’s goal, according to then CMO Suzy Deering , was to get back into the consciousness of young people after it had not been noticed by them at all – with initial success. 32% of all new sellers were GenZ in 2021. At the same time, the company is trying to get rid of its image as a marketplace for cheap copies and fakes by offering certifications.

In fact, the online trading platform’s business has been better again recently. Revenue for the past fiscal quarter was $2.5 billion – slightly better than analysts expected. For the current quarter, Ebay forecast sales of up to 2.54 billion dollars, which was also above Wall Street’s forecasts. Earnings per share for the first quarter of 2023 were $1.07. In the year-ago quarter, it was still $1.05 per share.

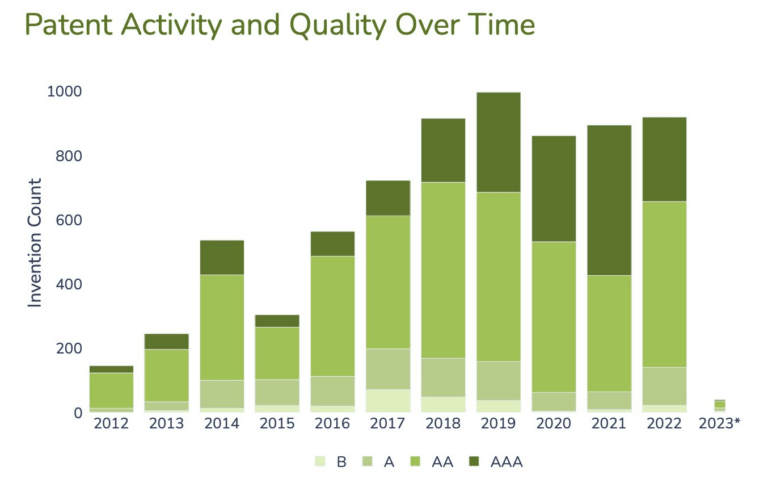

In terms of innovative strength, ebay is therefore well positioned as well. The average Quant IP quality rating of the company’s patent portfolio is AA, which means that eBay Inc.’s patents are on average better than 75.0% of the comparable patents of its competitors. The only downside is that the number of innovations has declined. Still, a Quant IP Technology Disruption Index of 74 indicates that eBay Inc. is well suited to withstand disruptive technological forces.

For value investors, the stock is definitely worth a look. eBay has paid a dividend for four years and has not lowered it in four years. While the yield of around 2 percent isn’t particularly exciting, the growth rate is enticing. The dividend growth rate has averaged 16% over the past three years, and is expected to grow even faster in 2022. In addition, the stock not expensive in terms of the most common metric valued: The price/earnings ratio is just under 14.

Conclusion: eBay could benefit from the sustainability trend and further expand its position as a value stock – a good risk-return profile with lucrative dividend growth.