Balance sheet fraud and lack of supervision are the focus of the Wirecard disaster. But just one look at the patent data would have been enough to ask management unpleasant questions about the core business.

In September 2018, Wirecard ousted Commerzbank from the DAX. A Fintech company displaces a traditional bank. This fitted into the success story of the self-appointed technology group from Aschheim near Munich. Finally, a tech company from Germany that made the breakthrough. Some headlines saw Wirecard on a par with SAP.

Wirecard itself wrote in its Annual Report 2018: “As a global leader for innovation in the payment industry and a supplier of solutions for electronic payment transactions, the growth of the global digital payment market is crucially important to the Wirecard Group”. The word innovation appeared in the annual report a total of 18 times. But the entire technology, the entire IP of the company with a market capitalization of around 25 billion euros was protected by just one single patent.

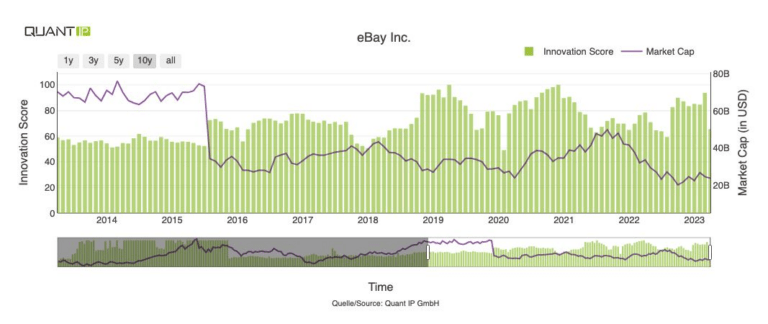

Just how far Wirecard was from being a genuine technology group is also made clear by a look at the Quant IP Innovation Score, which, despite all the hype, only fluctuated around 25 points (maximum value 100):

Should one have already suspected a case of fraud based on the patent weakness and the low innovation score? Certainly not. But the big gap between the company’s own presentation of itself as a global technology group and the innovation key figures fits into Wirecard’s picture: Almost nothing was as it seemed. In any case, the Wirecard share has never been an issue for our equity fund due to the low innovation score.